Capital Flows, Contrasts, and Corrections — Nov 1, 2025

Markets are digesting mixed earnings, insider selling in high-growth tech, renewed trade tensions, and a behavioral shift in how capital is managed. From Robinhood’s surge to Texas’ tax policies, here’s what’s shaping the next rotation.

1. Robinhood’s Blowout Quarter Highlights Retail Resilience

Robinhood Markets (NASDAQ: HOOD) reported Q2 2025 revenue of $989 million (+45 % YoY) and EPS $0.42 vs $0.31 expected, driven by strong options and crypto volumes. While engagement rose, higher regulatory costs could trim future margins.

Investor takeaway: Retail flow remains sticky despite volatility, but margin compression risks remain.

Source: Investopedia

2. CoreWeave Insider Sale Raises Valuation Questions

Magnetar Financial offloaded $44.9 million of CoreWeave stock, prompting a ~10 % decline in the AI-infrastructure firm’s share price. The sale follows a wave of insider disposals after lock-ups expired.

Investor takeaway: Heavy insider exits at elevated valuations often precede sentiment resets. Monitor fund filings and option activity for trend confirmation.

Source: Investing.com

3. U.S.–China Tariffs Rekindle Global Market Volatility

Renewed tariff threats—including potential 100 % duties and tighter software export rules—sparked volatility across equities and commodities. Gold and Treasuries caught safe-haven bids while chipmakers slid.

Investor takeaway: Policy shocks can reverse market momentum quickly; maintain optionality via hedges or rotation into low-beta assets.

Source: Reuters

4. Mega-Brewers Defy Slowdown With Strong Cash Flow

Global brewers like AB InBev and Heineken boosted free cash flow through price increases and efficiency cuts, rewarding shareholders with dividends and buybacks despite sluggish volume growth.

Investor takeaway: Defensive yield names are quietly outperforming high-beta peers—watch consumer-staples rerating.

Source: Financial Times

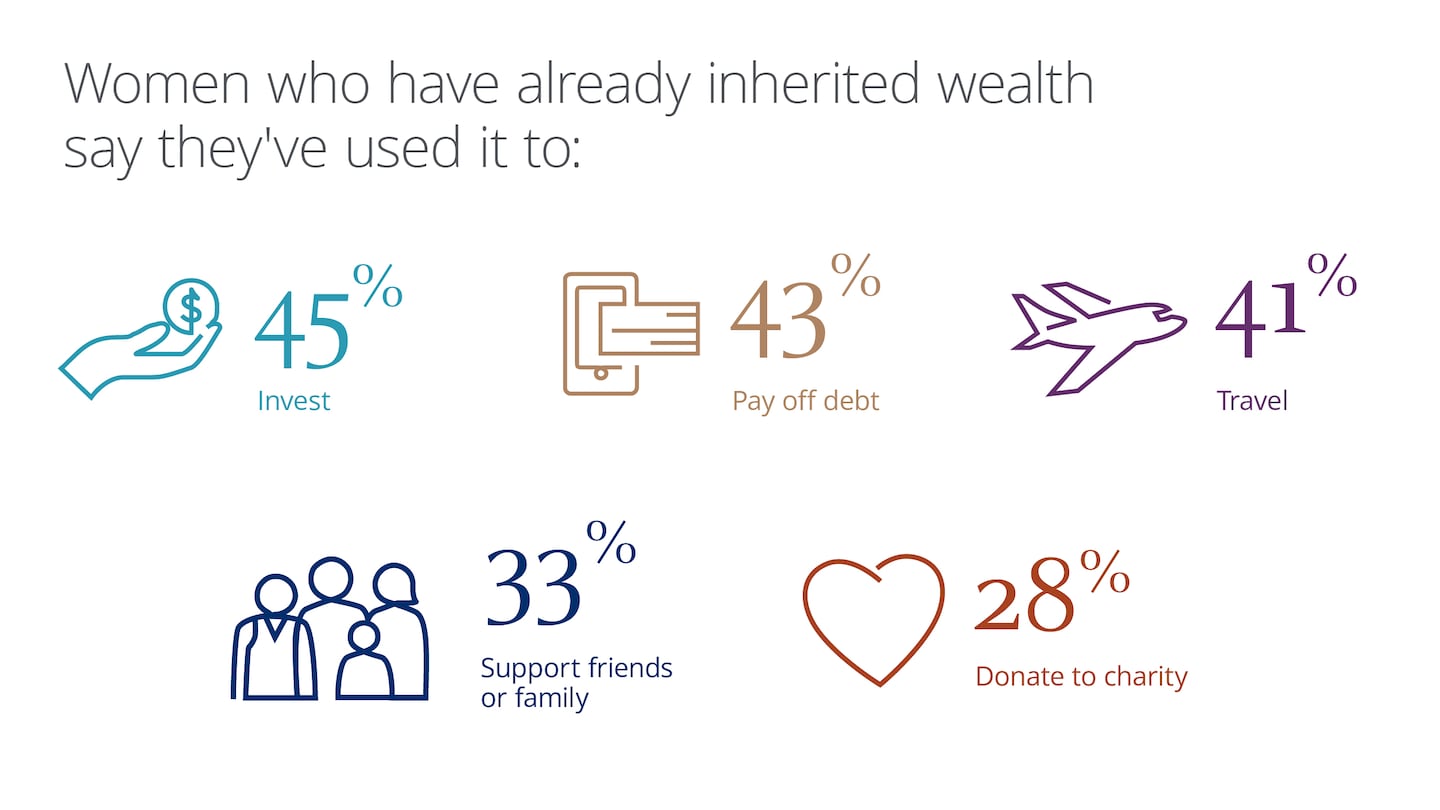

5. Women’s Wealth and Behavioral Finance Are Reshaping Investing

J.P. Morgan Wealth Management reports a record rise in women independently managing investments—signaling a demographic shift in financial behavior. Behavioral-finance studies show emotion-driven biases are narrowing across genders.

Investor takeaway: Expect rising demand for tailored advisory models, financial education tools, and gender-inclusive product design.

Source: Finance Yahoo

💡 Bottom Line

Across earnings, insider activity, policy, and demographics, capital is being redistributed—not withdrawn. The opportunity lies in recognizing who’s buying, who’s selling, and which trends have structural momentum versus sentiment heat.